The Social Security System (SSS) is an insurance-company wherein members can make a monthly remit for entitlement of future benefits like pension, death claims, salary loan, and many others. One of the functions of the government-owned corporation that are availed by many of its members is the SSS Salary Loan.

The SSS Salary Loan Application is a very convenient service of Social Security System that made easier today because SSS members can now apply for a salary loan online. Getting an SSS salary loan can now be done at home by using a computer or any devices that have an internet connection.

Table of Contents

What is an SSS Salary Loan?

Who are Qualified To Apply for an SSS Salary Loan?

How Much Can I Borrow From the SSS Salary Loan Program?

How to Compute Your SSS Salary Loan

What are the SSS Salary Loan Requirements?

How to Apply SSS Salary Loan Online

Repayment Term and Schedule of Payment

Interest and Penalty of your SSS Loan

Deduction of Unpaid SSS Loan from Benefits

SSS Loan Renewal

The Social Security System offers two types of loans: salary and calamity loans. Salary loans depend on the monthly wage of employees, while calamity loans can be obtained if they live in an area declared to have suffered from natural calamities.

SSS member may submit the salary loan application to the nearest branch office of the SSS or submit it online using your My.SSS account. In this article, We will discuss how to apply SSS loan online. It is important that you have your SS number and My.SSS account. This guide contains useful general information you may need to know about SSS salary loan online application.

What is an SSS Salary Loan?

In a nutshell, SSS salary loan is a cash loan that SSS members, whether employed or self-employed/voluntary, can avail of to meet their short-term needs.

Due to the fast approval process and low-interest rate, SSS salary loan is the most popular and most availed program of the Social Security System. In 2019 alone, a total of 29.98 billion worth of SSS salary loans were released and issued to 1.46 million members who availed of the said loans from January to September1.

Who are Qualified To Apply for an SSS Salary Loan?

To avail of the salary loan, the SSS member must meet the following eligibility requirements:

- Must be under 65 years old at the time of application;

- Must be a regular paying SSS member (employed, currently contributing self-employed, or voluntary). To qualify for a one-month loan, the member must have paid 36 monthly contributions, 6 of which should be within the last 12 months prior to the month of filing of the application. Meanwhile, in order to avail of a two-month loan, the member must have paid 72 monthly contributions, 6 of which should be within the last 12 months before the month of filing of application;

- If employed, the employer must be updated when it comes to payment of contributions and loan remittances;

- Has not been granted any of the final benefits which include death, retirement, and total permanent disability benefit;

- Has not been disqualified due to fraud committed against SSS.

How Much Can I Borrow From the SSS Salary Loan Program?

Members who have paid 36 monthly contributions are qualified to avail of the one-month salary loan which is equivalent to the average of the member’s 12 latest posted Monthly Salary Credits (MSCs), rounded to the next higher MSC, or the amount the member applied for, whichever is lower. Since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000.

Meanwhile, members who have paid 72 monthly contributions are qualified to avail of a two-month salary loan which is equivalent to twice the average of the member’s posted Monthly Salary Credits (MSCs) in the last 12 months, rounded to the next higher MSC, or the amount the member applied for, whichever is lower. Given the maximum Monthly Salary Credit is currently 25,000, members under this category who regularly pay the maximum amount of contribution can borrow the maximum loanable amount of Php 50,000.

Take note that the final amount will still be subject to deductions. These include the advance interest and a service fee equivalent to 1% of the loan amount. If you’re borrowing Php 37,000, for example, you will only get Php 36,315.75 after the deduction of the advance interest amounting to Php 314.25 and a service fee of Php 370.

How To Compute Your SSS Salary Loan

Let’s say you have a monthly income of Php 18,000. Based on the contribution table, your income falls within the salary range of Php 17,750 – Php 18,249.99 which has the Monthly Salary Credit (MSC) of 18,000.

In order to compute your loanable amount, you need to get the average of your latest 12 Monthly Salary Credits (MSCs). Assuming that your income never changed and you paid your contributions consistently in the last 12 months, the maximum SSS salary loan you can borrow is Php 18,000 for a one-month salary loan and as much as Php 36,000 for a two-month salary loan, provided that you’re qualified for it.

Take note that you can borrow the exact maximum loanable amount or anything lower than that, depending on how much money you need at the moment. From the loan proceeds, a 1% service fee and an advanced interest will be deducted by SSS. On the other hand, if you have an outstanding balance of another SSS short-term loan, it will be deducted from the amount of your approved SSS salary loan.

What are the SSS Salary Loan Requirements?

In accordance with the SSS Circular 2019-0142, member-borrowers who want to avail of the SSS salary loan are now required to file the application online.

- Stable Internet connection

- My.SSS account

- Preferred electronic loan disbursement channel where you want to receive the loan proceeds.

As of 2021, loan disbursement via check is no longer available. Instead, you can choose from any of the following disbursement methods:

- PESONet-participating bank. If you have an account with any PESONet-accredited bank, you can enroll it using the Disbursement Account Enrollment Module inside your My.SSS account. Make sure that you’re the sole bank account holder as joint accounts will not be accepted.

- e-wallet/RTC/CPO. In case you don’t have a PESONet-accredited bank account, you can also opt to receive the loan proceeds via GCash, PayMaya, DCPay Philippines, or DBP Cash Padala thru M Lhuillier.

- SSS-issued UBP Quick Card. Take note that UBP accounts linked with other government offices (e.g., Pag-IBIG Loyalty Card) are not allowed. UBP Quick Cards start with “10” and composed of only 12 digits.

How to Apply SSS Salary Loan Online

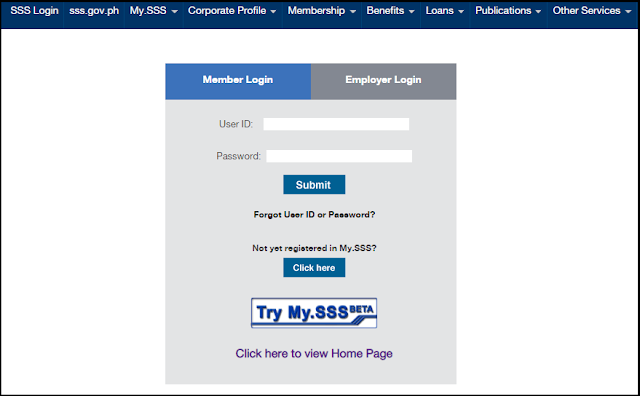

Step 1: Go to SSS website first and log-in as SS member. If you don’t have an account, registered first at My.SSS.

Step 2: Once you access your My.SSS account, Under e-services, click the Salary loan and then input the required details needed.

Step 3: The online application form will need your Employer ID, Employer Name, Branch Office and Loanable Amount. Input the details correctly, especially your loan amount and click the proceed button.

Step 4: You will see your disclosure statement details. You may print it out and click the submit after. The disclosure inputs the loan amount, other charges/deductions, payment schedule, and interest fees.

Step 5: Once you’re done, you’ll see that you have successfully submitted your online salary loan application. The salary loan submitted online will be directed to the employer’s My.SSS account for certification, hence, the employer should also have an SSS Web account.

You may also notify your employer or the HR department about your salary loan application. Once your application is approved, you just have to wait for about 2 to 3 weeks. You will be notified when your check is ready for pick-up at SSS branch office.

Important Note: The salary loan submitted online by an employed member will be directed to the employer’s My.SSS account for certification, hence, the employer should also have an SSS Web account .The employer shall submit an updated Specimen Signature Card (SS Form L-501) to be updated annually to avoid delay in the processing of salary loan applications.

The Loan applications whether via the SSS website or processed at a branch – take two to three weeks to approve from the date of application, providing that all necessary documents have been submitted.

For employed members, the check is released to their employers. OFW members and self-employed members will be notified when their check is ready by the SSS branch they applied from.

Checks are issued by the Philippine National Bank (PNB) and can be encashed at any PNB branch. Note that you’ll need to bring two valid photo IDs with signatures for verification. There’s also a 1% service fee that will be charged to your total loan proceeds.

Repayment Term and Schedule of Payment

- The loan shall be payable within two (2) years in 24 monthly installments.

- The monthly amortization shall start on 2nd month following the date of loan, which is due on or before the payment deadline, as follows:

- Payment shall be made at any SSS branch with tellering facility, SSS-accredited bank or SSS-authorized payment center.

Interest and Penalty of your SSS Loan

- The loan shall be charged an interest rate of 10% per annum based on diminishing principal balance, and shall be amortized over a period of 24 months

- Interest of 10% shall continue to be charged on the outstanding principal balance until fully paid

- Any excess in the amortization payment shall be applied to the outstanding principal balance

- Loan amortization not remitted on due date shall bear a penalty of 1% per month until the loan is fully paid.

Deduction of Unpaid SSS Loan from Benefits

In case of default, the arrearages/unpaid loan shall be deducted from the benefits claimed by the member, whichever comes first, as follows;

- For self-employed/voluntary member, deduction shall be from short-term benefits (Sickness/Maternity/Partial Disability).

- In case of member-borrower’s death, total disability or retirement under Social Security Act, the entire amount or any of unpaid amount of the loan as well as the interest and penalty thereon, if any, shall be deducted from the corresponding benefit.

SSS Loan Renewal

- Renewal shall be allowed after payment of at least 50% of the original principal amount and at least 50% of the term has lapsed.

- Proceeds of renewal loan is any amount greater than or equal to zero as long as the outstanding balance on the previous loan is deducted.

We hope that you find the general guide for SSS salary loan online application very useful. If you have concerns and inquiries regarding your SSS-transaction, you can call SSS at 920-6446 to 55 or send an email to member_relations@sss.gov.ph.

0 Comments